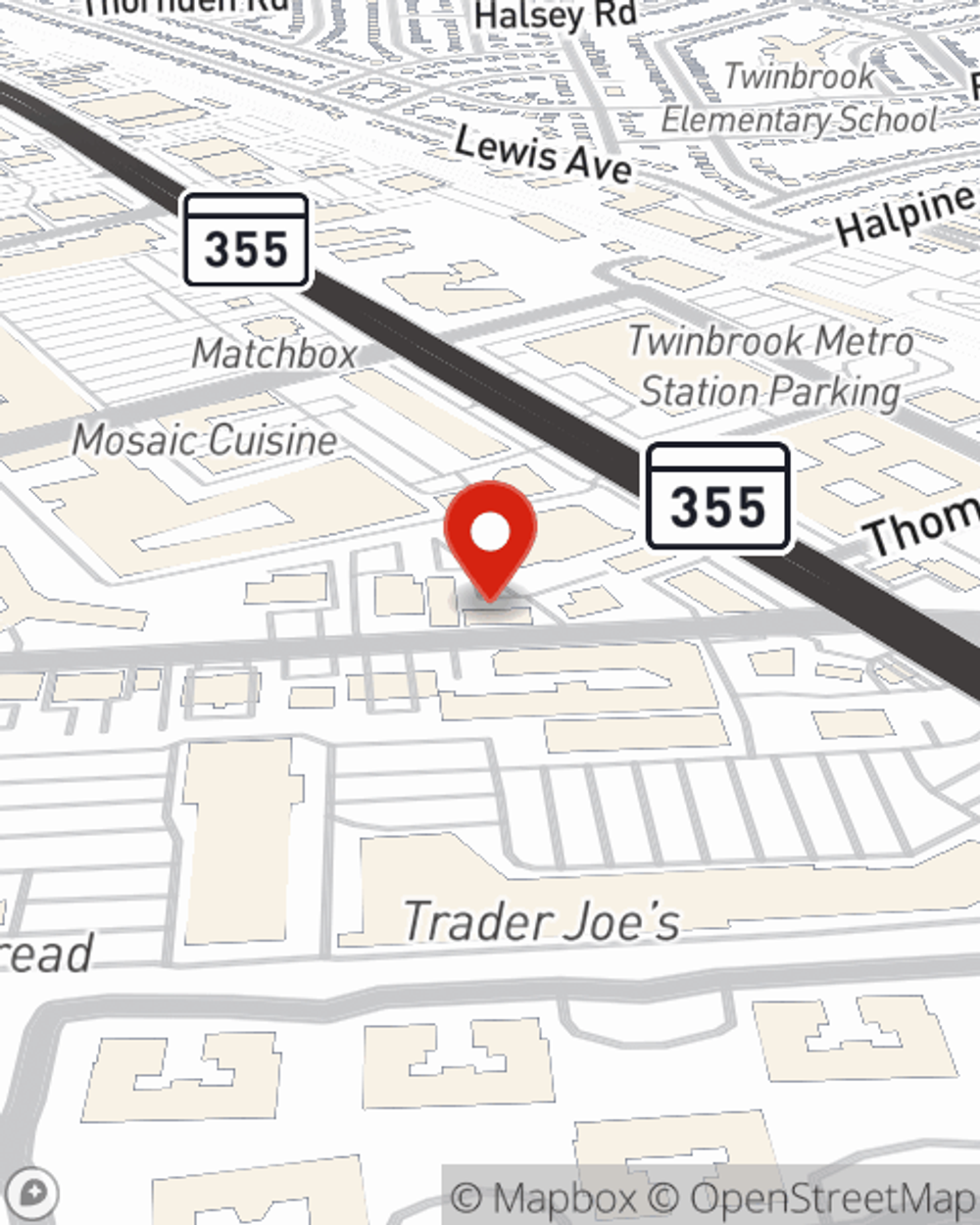

Business Insurance in and around Rockville

Researching protection for your business? Look no further than State Farm agent Jimmy Reid!

This small business insurance is not risky

State Farm Understands Small Businesses.

When you're a business owner, there's so much to remember. It's understandable. State Farm agent Jimmy Reid is a business owner, too. Let Jimmy Reid help you make sure that your business is properly covered. You won't regret it!

Researching protection for your business? Look no further than State Farm agent Jimmy Reid!

This small business insurance is not risky

Customizable Coverage For Your Business

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a hair stylist or a pet groomer or you own a dry cleaner or a dance school. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Jimmy Reid. Jimmy Reid is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Get in touch with State Farm agent Jimmy Reid's team today with any questions you may have.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Jimmy Reid

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.